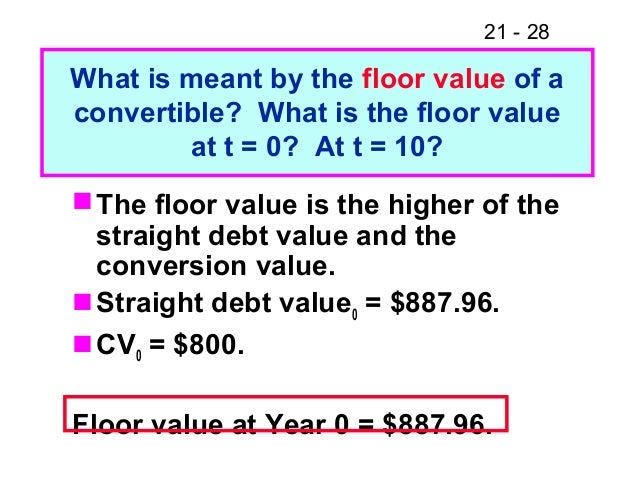

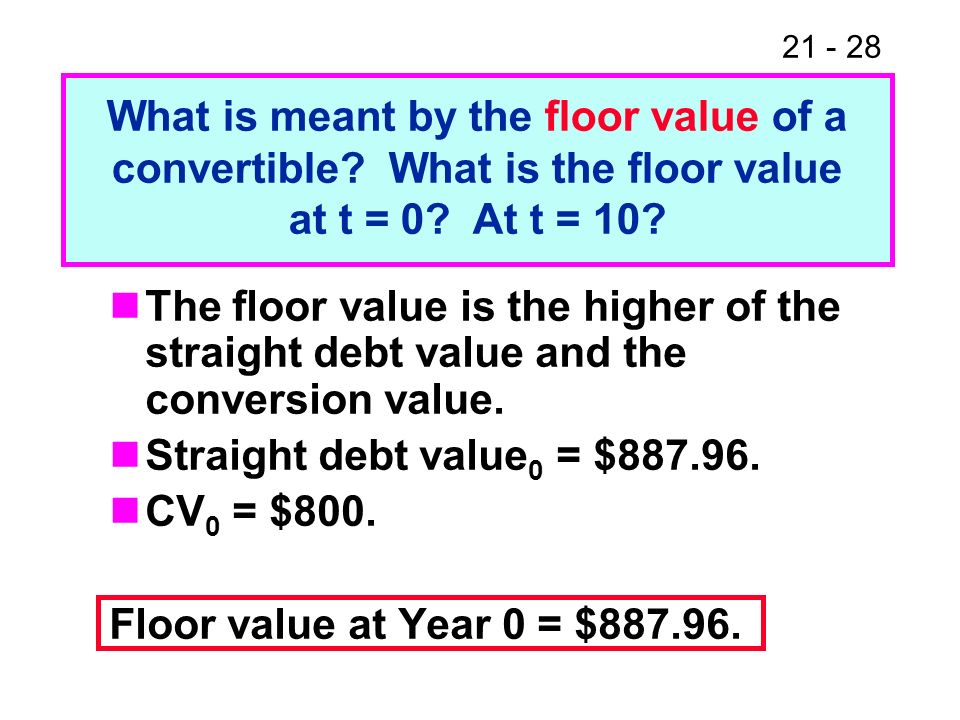

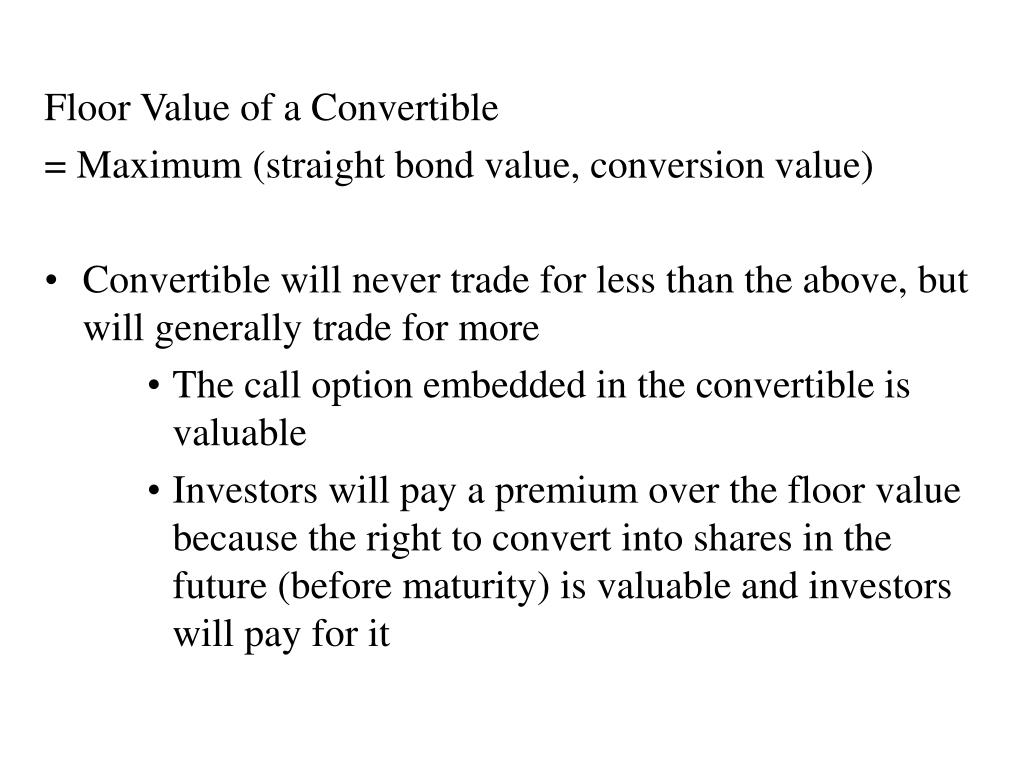

The lowest value that convertible bonds can fall to given the present value of the remaining future cash flows and principal repayment.

Floor value of convertible bond calculation.

It is calculated assuming that the holders take cash on redemption rather than convert.

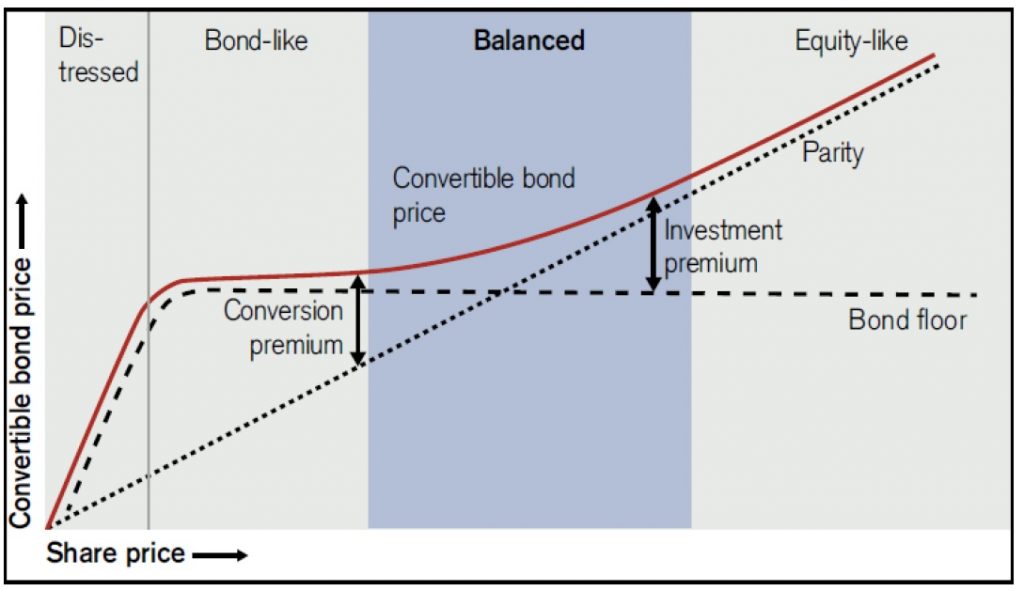

The convertible bond will outperform the company s stock when the stock declines in value because the convertible has a price floor equal to the straight bond value.

Floor value the floor value of a convertible bond is the greater of 1.

Convertible bonds unlike more typical stock shares have a floor value.

It s important to know how to calculate this value so that you can sell or convert the bonds while they still retain value.

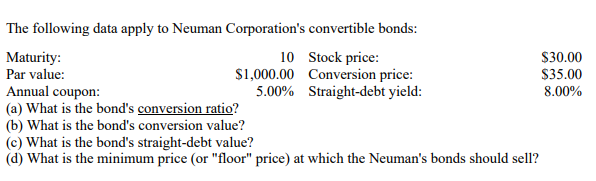

Concluding the example divide 1 000.

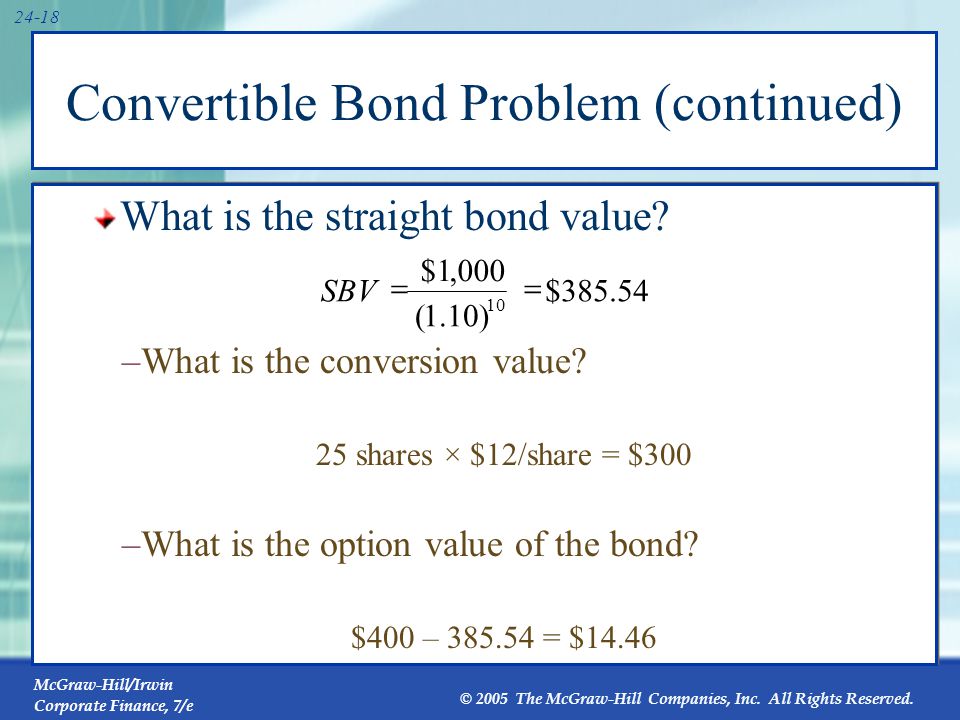

Where cv stands for conversion value and bv stands for bond value without the conversion feature i e.

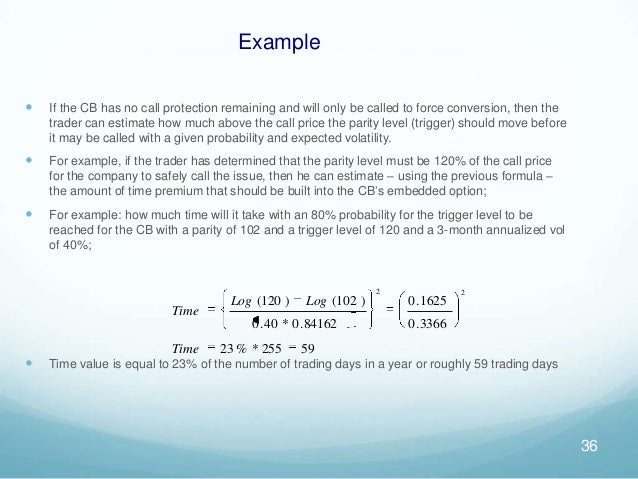

Bond investment value value as a corporate bond without the conversion option based on the convertible bond s cash flow if not converted.

Divide the convertible bond s face value by your step 5 result and add this calculation s result to your step 8 result to figure the bond s floor value.

A technology company issued 100 million in convertible bonds on 1 january 20x1 with a maturity date of 31 december 20y5.

Usually bond holders will be expecting to convert because they are expecting that the shares will be worth more than the cash alternative and so you would usually expect the actual market value to be higher than the floor value.

To estimate the bond investment value one has to determine the required yield on a non convertible bond.

The last date of conversion is 31 december 20y0.

The convertible bond will underperform the company s stock when the stock appreciates significantly because the investor paid a conversion premium on the convertible bond.

But your profit will still be the bond s yield.

The value of a straight bond.

You will receive your principal on a specified maturity date.

It is the lowest market value that the bond can have.

The financial worth of the securities obtained by exchanging a convertible security for its underlying assets.

The floor value of the convertible bond is the lowest value to which the bond can drop and the point at which the conversion option becomes worthless.

:max_bytes(150000):strip_icc()/GettyImages-160519027-458287b2fbec405e85c38510953507ad.jpg)